Send money to Vietnam

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for your international transfer

- Connected bank account (ACH) fee1.65 USD

- Our fee7.02 USD

Should arrive in 30 minutes

Send money to Vietnam

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for your international transfer

- Connected bank account (ACH) fee1.65 USD

- Our fee7.02 USD

Should arrive in 30 minutes

How to send money to Vietnam from the UK

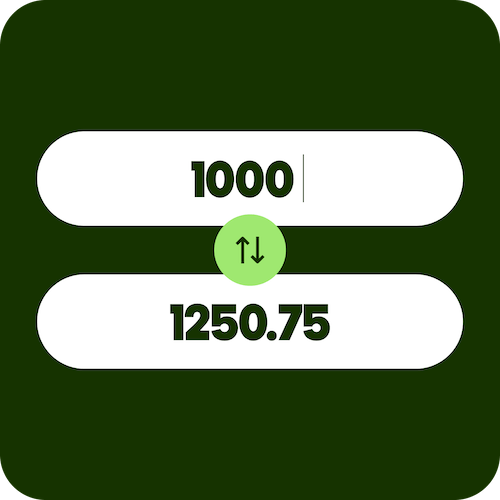

Enter amount to send in USD.

Pay in USD with your debit card or credit card, or send the money from your online banking.

Choose recipient in Vietnam.

Select who you want to send money to and which pay-out method to use.

Send USD, receive VND.

The recipient gets money in VND directly from Wise’s local bank account.

Larger transfers. Lower fees. Premium support.

Pay less when you send over 25,000 USD or equivalent. Plus get dedicated support from our expert team

Secure money transfers to Vietnam

Every transfer you make is protected with HTTPS encryption and 2-step verification. And we run millions of checks each day to protect every transaction from fraud.

- Rock-solid technologySuper smart Wisers have built our industry-leading security systems from scratch over the last 12 years.

- People who care, 24/7With over 1,000 anti-fraud specialists, and real human help available every minute, we’re on hand when you’ve got questions.

- Your money, not oursYour money is safeguarded, and held completely separate from ours, so it’s available to you all the time.

Best ways to send money to Vietnam with WISE

The best way to send United States dollar to Vietnamese dong is by using money that's in your Wise account. It's cheapest and usually arrives in seconds. Bank transfers are also cheap, but can be slower.

Direct Debit is a convenient option that lets us take money from your account once you have authorised the payment on our site. It takes a little more time for your money to reach Wise, and it can be more expensive than a bank transfer.

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.

If you’ve enabled Apple Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Apple Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.

If you’ve enabled Google Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Google Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.

How to receive money in Vietnam

When you transfer with Wise, you can receive to local bank accounts — no need for a Wise account. And since our price is transparent, you know exactly what you’ll get on the other side.

IBAN

IBAN

You can make easy IBAN transfers from both inside and outside Europe. All you need is the recipient’s name and account details. Learn more about IBAN transfers.

Swift

Swift

To send a quick and secure Swift payment, all you'll need is your recipient’s IBAN number. It’s that easy. Learn more about Swift payments.

Email

Email

To make payments using only email, all you need is your recipient’s email address. Learn more about Email transfers.

Cheapest way to send money to Vietnam from the UK

The cheapest way to send USD to Vietnam is by using money that's in your Wise account and costs 6.53 USD. We use the mid-market exchange rate — the fairest rate — and always show your fees upfront.

USD

VND

| Sending USD | Transfer cost | ||

|---|---|---|---|

| Direct debit | 8.67 USD | ||

| Bank transfer | 13.13 USD | ||

| Debit card | 42.77 USD | ||

| Credit card | 60.84 USD | ||

| Apple Pay | 70.85 USD | ||

| Google Pay | 70.85 USD | ||

Fastest way to send money to Vietnam from the UK

Sending money with Wise is super fast: 70% of transfers arrive in under 20 seconds, and 95% in less than a day. How long it takes depends on how you pay.

USD

VND

| Sending USD | Should arrive | ||

|---|---|---|---|

| Direct debit | in 30 minutes | ||

| Bank transfer | by Monday | ||

| Debit card | in 60 minutes | ||

| Credit card | in 60 minutes | ||

| Apple Pay | in 60 minutes | ||

| Google Pay | in 60 minutes | ||

Send money to Vietnam from the UK with the Wise app

Looking for an app to send money to Vietnam? Send money on the go with Wise.

Cheap transfers abroad

Free from hidden fees, you’ll always get the mid-market exchange rate with Wise.

Track exchange rates

Save your favourite currencies to check how the exchange rate changes over time.

Real-time notifications

Know exactly what you’ve spent, as soon as you spend it.

Send money to Vietnam from the UK with the Wise app

Looking for an app to send money to Vietnam? Send money on the go with Wise.

Cheap transfers abroad

Free from hidden fees, you’ll always get the mid-market exchange rate with Wise.

Track exchange rates

Save your favourite currencies to check how the exchange rate changes over time.

Real-time notifications

Know exactly what you’ve spent, as soon as you spend it.

4.3 / 5 on Trustpilot from 253,788 reviews

Do more with Wise in the US

You can use Wise for much more than just sending money. Here is what's available, based on where you live.

Receive money fast

Get paid easily in other currencies with global account details.

Save on spending abroad

Pay and withdraw cash worldwide without any foreign transaction fees.

Frequently asked questions

See where Wise works

- Send money

- Account details

- Hold and convert money

- The current Program Bank is JPMorgan Chase Bank, N.A., see Appendix 1 of the Program Agreement for the most updated list of Program Bank(s). Eligible customers must opt in to the interest feature. Participants will have the balance of their USD funds held in their Wise Account "swept" into a Federal Deposit Insurance Corporation ("FDIC") insured account at one or more participating banks (each, a "Program Bank") that will hold the deposit funds. For a complete list of Program Banks, please see Appendix 1 of the Program Agreement. Availability of FDIC deposit insurance for the deposit funds is subject to certain conditions. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The Program is not intended to be a long-term investment option, checking or savings account, investment contract or security.

For customers opted in to receive interest on EUR and GBP, the FDIC passthrough insurance provided by our program bank is for up to the equivalent of 250,000 in total for your USD, EUR and GBP combined balance amounts (collectively, the "Eligible Balances"). - Annual Percentage Yield (APY) - rates shown are true as of 18/12/2025. See Program Agreement for details.