What is PayNow money transfer?

You can make a PayNow money transfer conveniently through the Wise app or desktop site, simply by scanning the PayNow QR for your payment. All you’ll need to do is set up your Wise money transfer, and pick PayNow as the payment method. You’ll be shown a unique QR code and can then log into your mobile banking service to scan and pay easily.

The QR code you’re provided is specific to your PayNow transfer, so you should not share it with others.

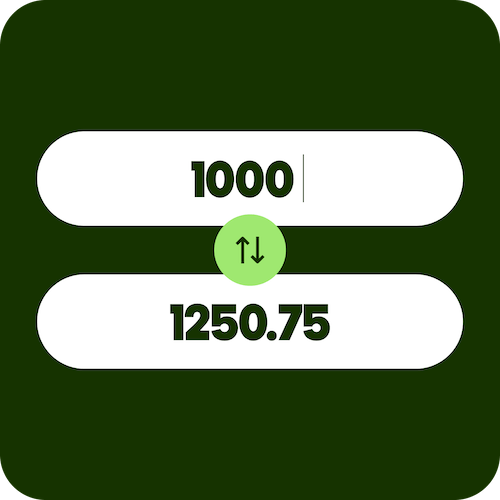

You can send up to 200,000 SGD per transfer when you use PayNow. There’s no limit to the number of transactions you can make - but you’ll need to make sure you’re paying from an account held in your own name.

Learn more about using PayNow.