What is ACH money transfer?

Making an ACH money transfer is often one of the cheapest ways to make a Wise international payment. You may need to also pay an ACH transfer fee to your bank - but while banks all set their own fees for outgoing ACH transfers, these are usually low, or even free.

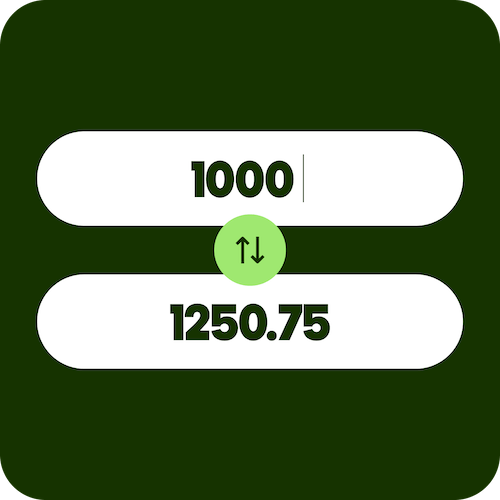

You can make a Wise ACH money transfer of up to 50,000 USD in 24 hours. There’s also a limit of 250,000 USD every 60 days if you have a personal account, or 400,000 USD if you have a Wise Business account.

When you set up a Wise money transfer and pay by ACH, the exchange rate is guaranteed as soon as you authorize payment to Wise. That means there are no surprises if the rates change while your ACH is winging its way to Wise - you’ll know exactly how much your transfer will cost you, and what rate you’re getting, straight away.

Learn more about using ACH transfers.