Request and receive money from all over the world

Get paid like a local with account details

From same-currency payments to international Swift transfers — get paid how you like, wherever you are.

Domestic account details

Share these for someone to pay you in the same currency by bank transfer. Get your salary in USD from the US, or EUR pension while you live in Australia. Fast and always free.

International account details

Share these for someone to pay you any currency we support by Swift transfer, from almost any country.

Get paid like a local with account details

From same-currency payments to international Swift transfers — get paid how you like, wherever you are.

Domestic account details

Share these for someone to pay you in the same currency by bank transfer. Get your salary in USD from the US, or EUR pension while you live in Australia. Fast and always free.

International account details

Share these for someone to pay you any currency we support by Swift transfer, from almost any country.

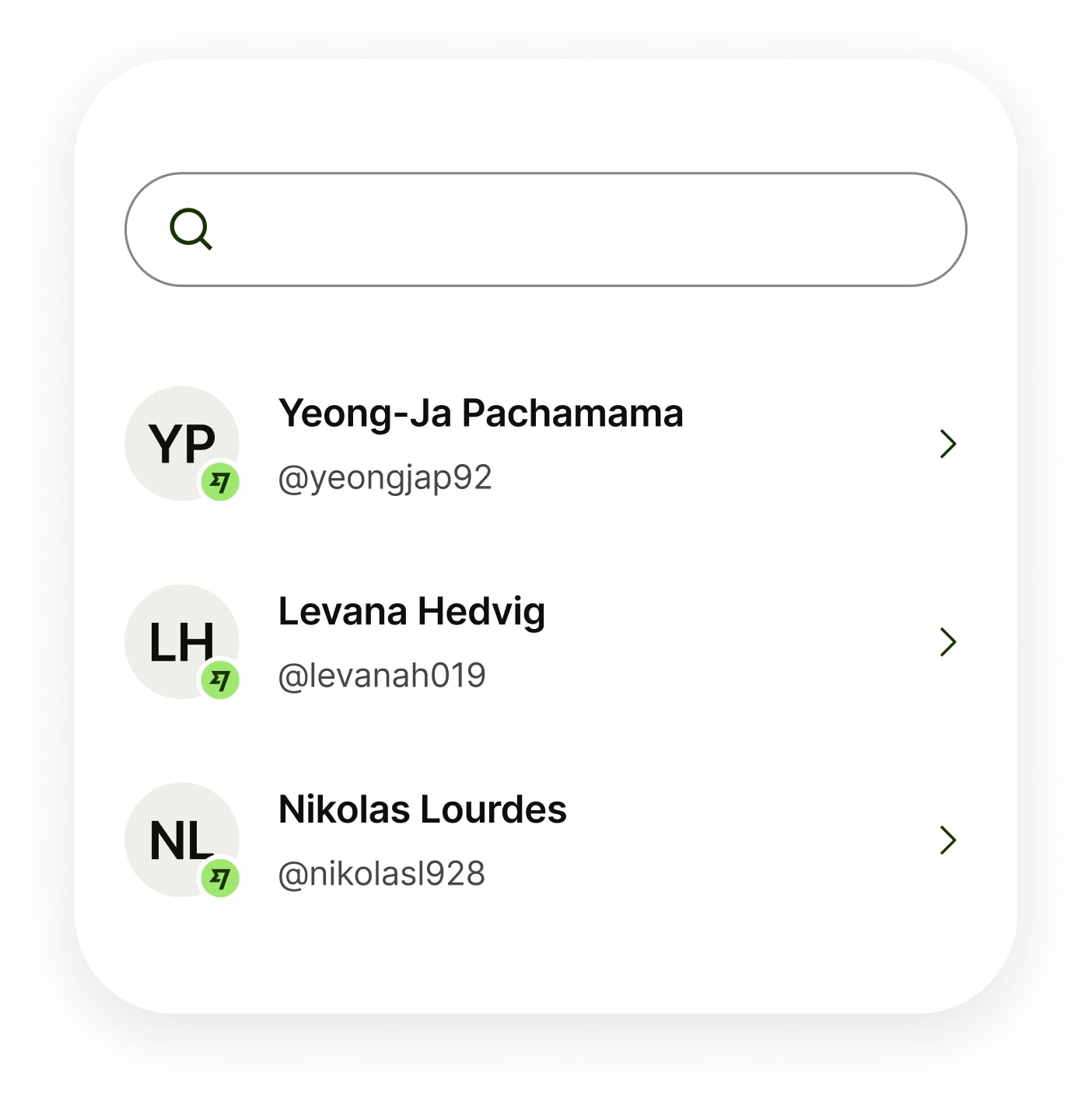

Settle up faster between friends

Make payments to your contacts on Wise, or request money from anyone with your unique Wisetag. Fast, free and no digits to forget.

So many ways to get paid

Once the money’s in your account you can keep it, convert it, or send it on.

- Share account detailsShare account details

Pick from 21 major currencies to receive money from anyone straight into your Wise account.

Request with WisetagRequest with Wisetag

Request with WisetagRequest with WisetagSet the currency, amount and share your QR code or link. Perfect for quick in-person payments.

- Sync your contactsSync your contacts

Request fast and free payments directly from your friends if they’re on Wise too. No emails or awkward texts.

Receive money for anything at all

Get your salary from another country

Get your salary from another country

Do work, get paid. Share account details to get your salary from overseas, without losing on the conversion.

Receive your pension from overseas

Receive your pension from overseas

Retired overseas? Claim your pension wherever life’s taken you. Receive the money straight into your Wise account without the sting of conversion fees.

Top up your money while studying abroad

Top up your money while studying abroad

Share your account details with your family or funding organisation, get paid and get back to the books.

Settle up with a link

Settle up with a link

Get even for dinner, trips or celebrations. Create a quick link and share to settle up in any currency we support.

Receive large amounts seamlessly

Receive large amounts seamlessly

Cashing out on a share sale, or getting a house payment from abroad? Get dedicated support and track your transfer as it makes it way to you.

Account details in 21 currencies

The world's money, all in your pocket.

Popular currencies in United States

Other currencies

Trust us to look after your money

We help over 14.8 million people move $49 billion every quarter — here's how we make sure it's safe.

- Privacy and dataWe protect your details through strict standards and 2FA.

- Dedicated supportQuestions? Get 24/7 help in 14 languages.

- International safeguardingWe're regulated by national authorities around the globe.

FAQs

Do more with Wise in the US

You can use Wise for much more than just receiving money. Here is what's available, based on where you live.

Send money worldwide

Make fast and cheap international transfers and save on fees.

Save on spending abroad

Pay and withdraw cash worldwide without any foreign transaction fees.

Trusted by millions

Millions of customers globally move around $16 billion each month

Regulated

All funds are deposited with banks like JPMorgan Chase Bank in the US

24/7 customer support

Get help from thousands of specialists any time over email, phone and chat

- The current Program Bank is JPMorgan Chase Bank, N.A., see Appendix 1 of the Program Agreement for the most updated list of Program Bank(s). Eligible customers must opt in to the interest feature. Participants will have the balance of their USD funds held in their Wise Account "swept" into a Federal Deposit Insurance Corporation ("FDIC") insured account at one or more participating banks (each, a "Program Bank") that will hold the deposit funds. For a complete list of Program Banks, please see Appendix 1 of the Program Agreement. Availability of FDIC deposit insurance for the deposit funds is subject to certain conditions. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The Program is not intended to be a long-term investment option, checking or savings account, investment contract or security.

For customers opted in to receive interest on EUR and GBP, the FDIC passthrough insurance provided by our program bank is for up to the equivalent of 250,000 in total for your USD, EUR and GBP combined balance amounts (collectively, the "Eligible Balances"). - Annual Percentage Yield (APY) - rates shown are true as of 12/18/2025. See Program Agreement for details.